Lic’s Amritbaal Yojana:Life Insurance Corporation of India is a trusted name in the insurance sector. Which provides many schemes for the life security and financial security of the people. Recently, LIC has launched LIC Amritbal Yojana to secure the future of the children of the country. This scheme is a combination of savings and insurance cover. Through which parents can save money for their child’s future education, marriage or other needs.

In this article, we are giving all the information about the features, benefits, eligibility and application process of the scheme.

Lic’s Amritbaal Yojana Quick Reviue:

| Name of the Scheme : | Lic’s Amritbaal Yojana. |

| Who started it: | The Insurance Corporation of India(LIC) |

| When did you start: | On February 17, 2023. |

| Beneficiaries : | Children of India. |

| Benefit : | Provides financial support for future education or marriage. |

| Age Limit : | From 30 days of birth to 13 years. |

| Sum Assured : | Rs.5 Lakh. |

| Annual premium: | Rs.90053/-. |

| Policy Term : | 5 year. |

| Maturity Amount: | Rs.5 Lakhs+Rs.15 Lakhs=Rs.20 Lakhs. |

| official website : | www.licindia.in |

Also Read About: How Check our LIC Policy Status.

Key features of Lic’s Amritbaal Yojana:

LIC Amrit Bal Yojana features are like this.

१.Guaranteed Benefits :Under this plan LIC gives a guaranteed benefit of Rs. 80/- per thousand per annum on the basic sum assured during the term of the policy.

For example:

If a person takes a policy of Rs.5 lakh for 7 years,

he will get a guaranteed benefit of (500000 sum assured / 1000 per cent X 80 =) Rs.40000/- per year.

- Customised Insurance:This plan gives the option to the person to choose the insurance coverage as per the future needs of his child.

- Flexibility in Premium Options:The insurer offers flexible premium payment options to choose a limited payment term such as 5, 6, 7 years or a single premium payment option for the plan.

- Loan Facility: In this scheme the insured can take a loan on his policy. This loan can be availed after 3 years in limited term payment and after 1.5 years in single premium payment.

- Premium Discount: In this plan, if the policy holder chooses the option of paying extra, then LIC gives premium discount on it.

Alos Read About: Pradhanmantri Jeevan Jyoti Bima Yojana.

lic amrit bal yojana eligibility criteria :

1.Age Limit :

a). Plan Entry Age Limit :

Minimum Plan Entry Age : 30 days after birth

Maximum Plan Entry Age : Upto 13 years.

b). Plan Maturity Age :

Minimum Age : 18 years

Maximum Age : 25 years

- Policy Term :

Minimum Policy Term :

In Limited Premium Payment Option : 10 years

In Single Premium Payment Option : 5 years

Maximum Policy Term :

In Limited Premium Payment Option : 25 years

In Single Premium Payment Option : 25 years

- Premium Payment Term :

In Limited Premium Payment Option : 5,6 & 7 years

In Single Premium Payment Option : One Pay

- Sum Assured :

Minimum Sum Assured : Rs.2 Lakhs

Maximum Sum Assured : No limit.

Risk Coverage : If the age of the child at the time of entry into the plan is less than 8 years, the risk coverage will commence after 2 years or after the child attains the age of 8 years, whichever is earlier, will be admissible.

Date of Vesting under the Plan : If the child attains the age of 18 years, the child shall become the owner of the policy immediately thereafter and an automatic agreement will be executed between the child insured and the LIC.

Amritbaal Yojana Benefits:

1.Guaranteed Additional Benefit: Under this plan LIC provides an additional guaranteed benefit of Rs. 80/- per thousand per annum on the total sum assured to its insured.

- Policy Maturity Benefit: After policy maturity, the policy holder will be given the total sum assured along with guaranteed additional benefits.

- Death Benefit Option Facility: The applicant is given two options of “Death Benefit” while purchasing the policy. Based on the future of the child.

| Premium Payment | Options | लाभ |

| Limited payout i.e. 5,6,7 year | Option-1 | 7 multiples of annual premium or basic sum assured. |

| Option-2 | 10 times the annual premium Or Basic Sum Assured. | |

| Single Premium Payment | Option-1 | Higher of 1.25 times the single premium or basic sum assure |

| Option -2 | 10 times the single premium. |

4.Tax Benefits: The premium amount paid for this plan is tax free under Income Tax Section 80C and the amount received after maturity of this plan is tax free under Income Tax Section 10(10D).

5.Preferred Benefits: Instalment waiver on death: If the policy holder dies before maturity, in limited pay option all the subsequent instalments are waived and the basic sum assured is given to the insured.

6.Premium Waiver Rider: This plan has a premium waiver rider option. That is, if the premium rider pays the fee along with the premium and the policyholder (parent or guardian) dies during the insurance period, the remaining premiums are waived off and the insured person (child) receives the maximum guaranteed benefit of the sum insured at the time of maturity. The insured can secure his insurance by paying this premium rider.

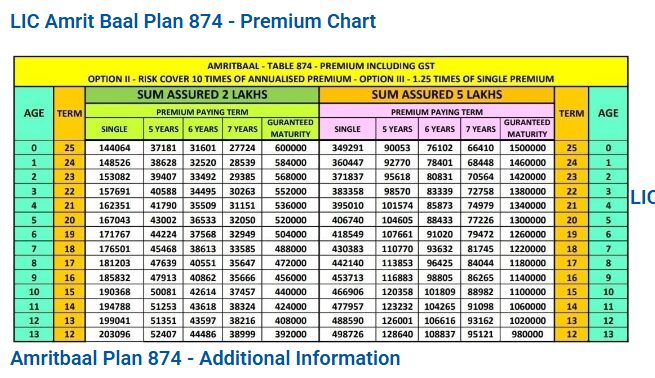

LIC Amritbaal Plan Calculator:

What is not included in LIC Amritbal Yojana?

If the insured commits suicide within 12 months from the commencement of the insurance risk, he will not get the death benefit. Only the amount of premium paid minus taxes and service charges will be given to his family.

If the insured person (child) is below 8 years of age and the insured person (parent or guardian) dies, then LIC does not provide death benefit.

If the insured person whose policy has lapsed revives his policy and commits suicide within next 12 months then he will not get death benefits.

How does LIC Amrit Bal Yojana work?

1.Policy purchase: Parents or guardians take out a policy in the name of the child.

- Premium Payment: The insurer pays the premium through limited payments or single payment.

- Maturity Benefit: After the policy term ends, the insured child receives a lump sum amount.

4.Death Benefit: In case of the death of the policy holder (parent or guardian) during the insurance term or before maturity, the child gets the basic sum assured. If the policy is taken with a rider, the child is given the sum assured along with guaranteed benefits.

LIC Amritbal Yojana Required Documents:

- Child certificate.

- Aadhar card, PAN card, resident certificate of the policy holder (parent or guardian).

- Income certificate (if required)

- Medical test (for higher cover)

- Bank passbook

LIC Amrit Bal Yojana Application Process:

Online Application Process:

- Visit LIC official website www.licindia.in.

- Select Amrut Bal Yojana in “Child Plan”.

- Complete the form.

- Upload necessary documents.

- Deposit the premium.

- Get the LIC Amrut Bal Policy Bond.

Offline Application Process :

Get LIC Policy Bond from branch office or agent.

Visit your nearest LIC branch or contact LIC agent.

Fill the proposal form.

Provide necessary documents.

Pay the premium.

Why choose LIC Amrit Bal Yojana?

Insurance for child’s future. Insurance for your child’s future A combination of insurance and savings for the future.

- Flexible premium payment options.

- Rider facility on the plan.

- Life insurance protection for parents.

Comparison of LIC Amrit Bal Yojana with other schemes :

| Amritbal Scheme | मनीबैक प्लान | Sukanya Samriddhi | |

| Type | Insurance + Savings | Money Bank | Government scheme |

| Tax benefit | Yes | Yes | Yes |

| Life Risk Cover | Yes | Yes | No |

| Return | Guarantee + Insurance | Bonus + Insurance | fixed interest |

LIC Amritbal Yojana Plan Number 874 Additional Information:

1.Locking period: This plan has a locking period of 3 years.

- Loan Facility: In the limited term insurance option of the plan, loan will be available after 3 years and in single premium option, loan can be availed after 3 months.

3.Revival Facility: If for any reason the policy is discontinued midway, it can be revived again within 5 years.

4.Policy Cancellation Facility: The policy holder is given the right to cancel the policy within 15 days from the commencement of the policy if he/she is not satisfied with the terms and conditions of the policy.

5.Maturity Amount Settlement Facility: In this scheme, LIC provides the facility to the customer to get the maturity amount in installments in 5, 10 or 15 years. It provides the flexibility to choose settlement options.

6.Proposal Form: To apply for this scheme you can use numbers 300 and 360.

LIC Amritbaal Agent commission:

On Term Payment:

1.For first year: 35% commission.

For all subsequent years: 5% commission.

2.On Single Premium Payment: No commission.

Important Links Of Lic’s Amritbaal Yojana:

2.Lic’s Amritbaal Yojana Guide Lines.

Frequintly Ask Questions About Lic’s Amritbaal Yojana:

एलआईसी अमृतबाल योजना क्या है?

एलआईसी अमृतबाल योजना एक ऐसी योजना है जो बच्चोंके भविष्य यानि शिक्षा या शादी के लिए ली जाती है.

एलआईसी अमृत बाल के क्या फायदे हैं?

इस योजना में बच्चे के भविष्य के लिए बचत और बिमा का मिश्रण है। LIC इस पे गारंटी बोनस देती है।

LIC अमृतबाल योजना आयु की सिमा क्या है ?

इस योजना में प्रवेश के लिए न्यूनतम आयु बच्चा जन्म से ३० दिन बाद और अधिकत्त १३ वर्ष है।

You are heartily welcome to our blog! We are four friends who run a Common Service Center (CSC) in India. We help people take advantage of the schemes of the Central and State Governments of India. On this blog, we authentically reach people with real and true information about government schemes. Our Official email is supportteam@bharatsarkarsuvidha.com